The top story from the week is the announcement that Marriott will buy Starwood Hotels and Resorts. The combined entity will be the largest company in the world, with thousands of hotels and 30 different brands under the Marriott umbrella. What's the rationale behind Marriott's latest move?

- Over 60% of Marriott's hotel inventory is in the USA. Starwood has a significant international presence, with hotels in over 100 countries globally. The combined entity will be a powerhouse, offering product for every customer segment and price point, all over the world.

- Marriott has always admired Starwood's innovative spirit, and will now be able to tap into Starwood's ingenuity and ability to create new products, new brands, and new services.

- Marriott and Starwood have the 2 industry-leading frequent guest programs. Combining Marriott Rewards with Starwood's SPG will create an even stronger loyalty program.

The purchase and merger will take place next summer, around July of 2016. The merger is a combination of two hotel chains that were, previously, rivals. It's not clear what will happen to their respective rewards programs. Starwood's rewards program, Starwood Preferred Guest, is particularly popular and offers points — called "Starpoints" that can translate into everything from hotel stays to charitable donations to frequent flier miles.

The purchase and merger will take place next summer, around July of 2016. The merger is a combination of two hotel chains that were, previously, rivals. It's not clear what will happen to their respective rewards programs. Starwood's rewards program, Starwood Preferred Guest, is particularly popular and offers points — called "Starpoints" that can translate into everything from hotel stays to charitable donations to frequent flier miles.

"We have competed with Starwood for decades and we have also admired them," said J.W. Marriott, Jr., executive chairman of Marriott, in a statement. "I'm excited we will add great new hotels to our system and for the incredible opportunities for Starwood and Marriott associates."

Starwood's fate has been up in the air since the beginning of this year when its CEO resigned abruptly amid concerns about flagging growth. In April, the hospitality company said it was exploring strategic alternatives, including a possible sale.

"Our board concluded that a combination with Marriott provides the greatest long-term value for our shareholders and the strongest and most certain path forward for our company," Bruce Duncan, chairman of the board at Starwood, said in a statement.

Wall Street appeared to have reservations about the deal. Marriott stock was down slightly by about 1% in early trading following the announcement. Starwood stock was down by as much as 5% in early trading.

For now - it's business as usual. Marriott and Starwood will continue to operate as two separate companies.

News & Blog Categories

Trending Posts

Recent Posts

Featured Posts

![]()

Travel Insurance with AIG Travel Guard

We have plans. Lots of them. Why? So you can easily find the one that fits. And with our plans, it’s not just about coverage. It’s about unique services. Lost your bag? We can help track it with Bag Trak®. Or we can cover your losses if it isn’t found. It’s simple. We have the coverage options and assistance services you want for your globetrotting travels. Read More

Travel Restrictions by Sherpa What to know

Future Cruise Credits What to know

If you are holding on tight to your Future Cruise Credits (FCCs) waiting for the perfect time and itinerary to put them back in use, many of them expire soon! Now is a great time to check the status of your FCC with an All-Travel Travel Advisor. Read More

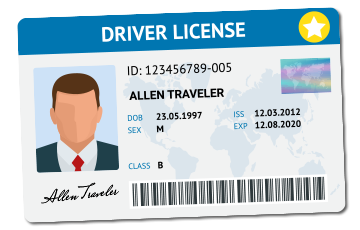

Real ID Deadline Extension

Starting on May 3, 2023 travelers who elect to use a state-issued driver’s license at Transportation Security Administration (TSA) airport checkpoints must ensure that they are Real ID-compliant, which is designated by a star in a circle in the upper right corner of the license. Read More